Inflation and its impact on real estate

Alex Dunn, Research Manager, Cromwell Property Group

Inflation is a key component of any economy. A change in the inflation rate is often seen as an early sign of impending change and the end of an economic cycle. A sudden spike in inflation can have a significant impact on investment portfolios particularly if investors fail to navigate it successfully.

A dangerous mix of closed businesses, higher unemployment rates and large injections of monetary stimulus from governments around the world, all as a result of COVID-19, has led to many experts predicting higher-than-normal rates of inflation are on the medium-term horizon.

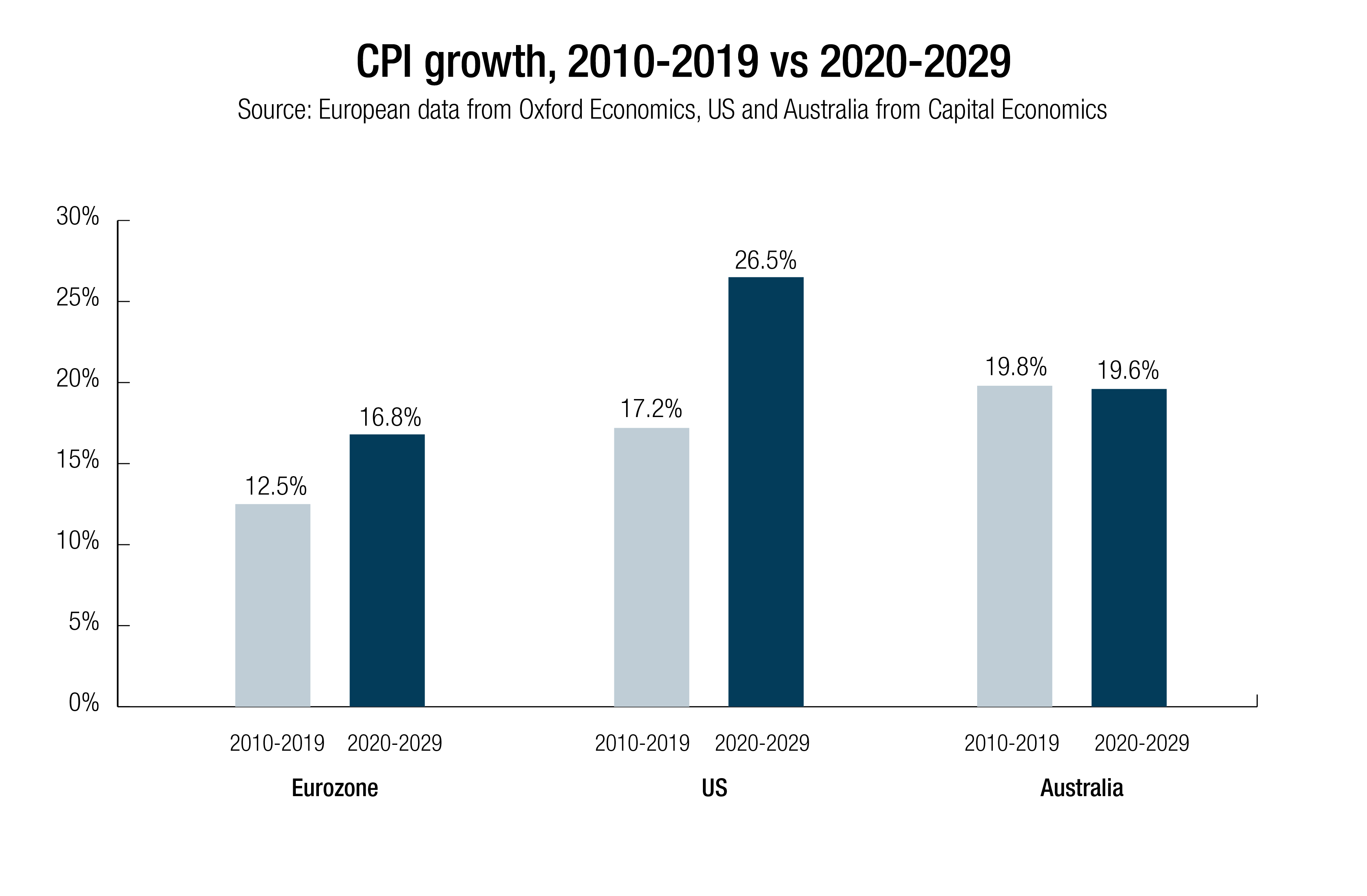

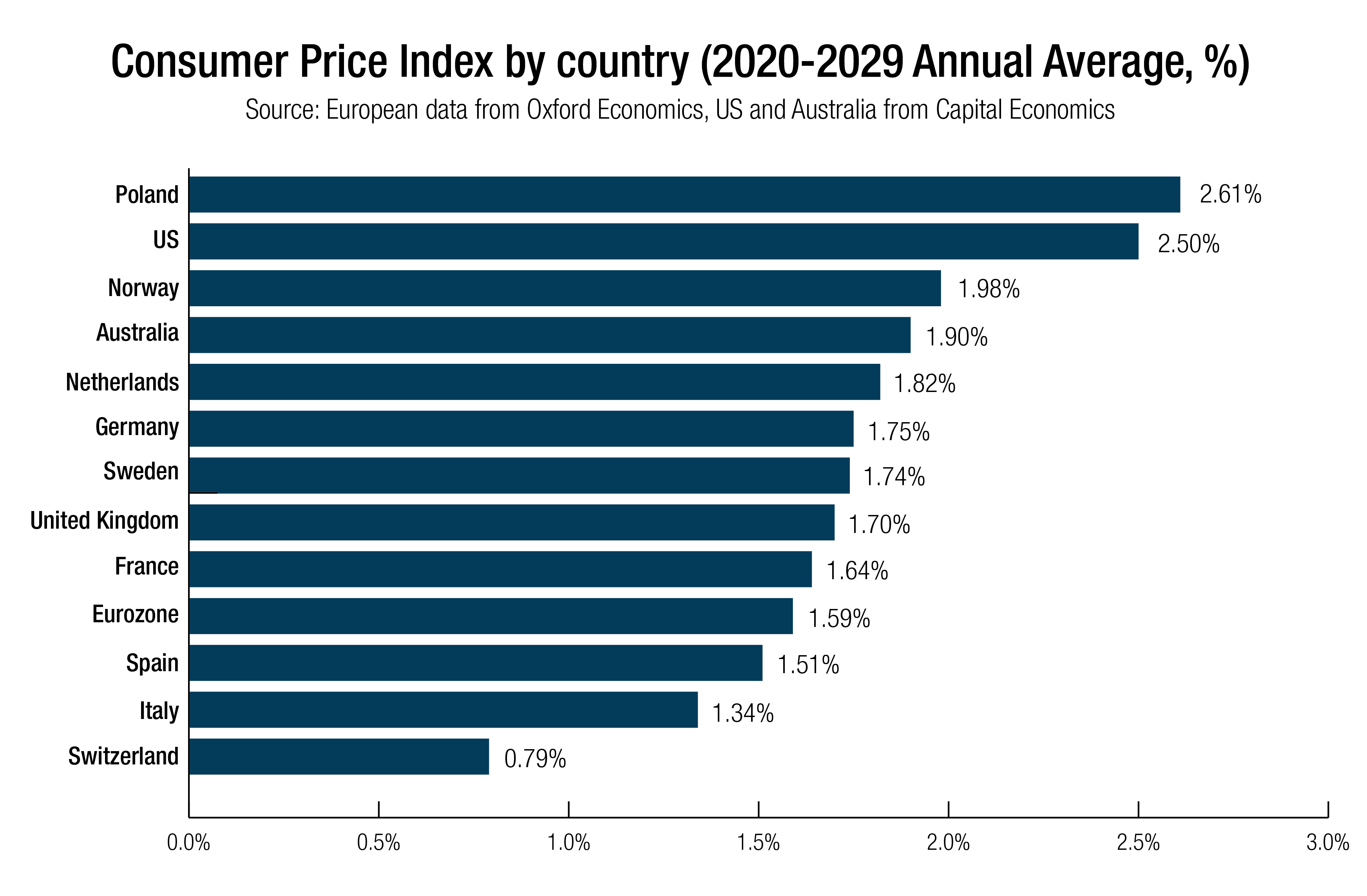

In the US and across European economies, future inflation is forecast to be far higher than it was over the previous decade. In Australia, inflation is also expected to be relatively high, rising by 1.9% per year on average. High inflation would see interest rates rising, impact exchange rates and push highly indebted individuals, investors, businesses and governments closer to default.

The dominant concern of central banks at the moment, however, is still to try to raise inflation and inflation expectations hoping that this will be enough to raise interest rates above zero. This would provide room to manoeuvre in response to future negative economic shocks.