German logistics – Diversify for performance

Michael Bohde, Head of Germany, Cromwell Property Group

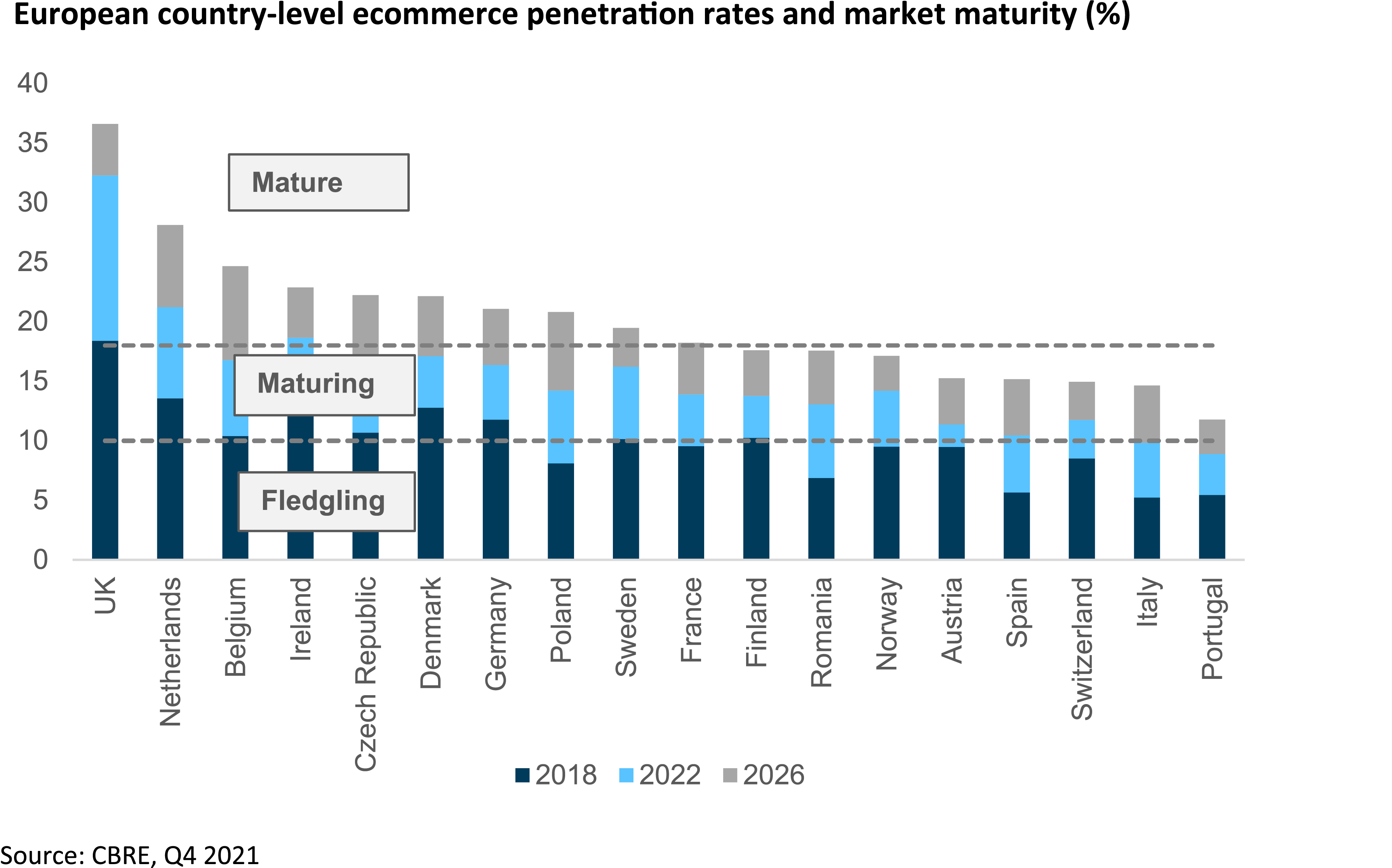

German logistics is hot. Occupational activity has been record-breaking as rising ecommerce penetration and the shift towards supply chain resiliency has supported demand. According to our calculations an additional two million sqm of logistics space alone will be needed in Germany over the next five years to accommodate ongoing growth. Given land supply is highly constrained, this bodes well for future rental growth prospects.

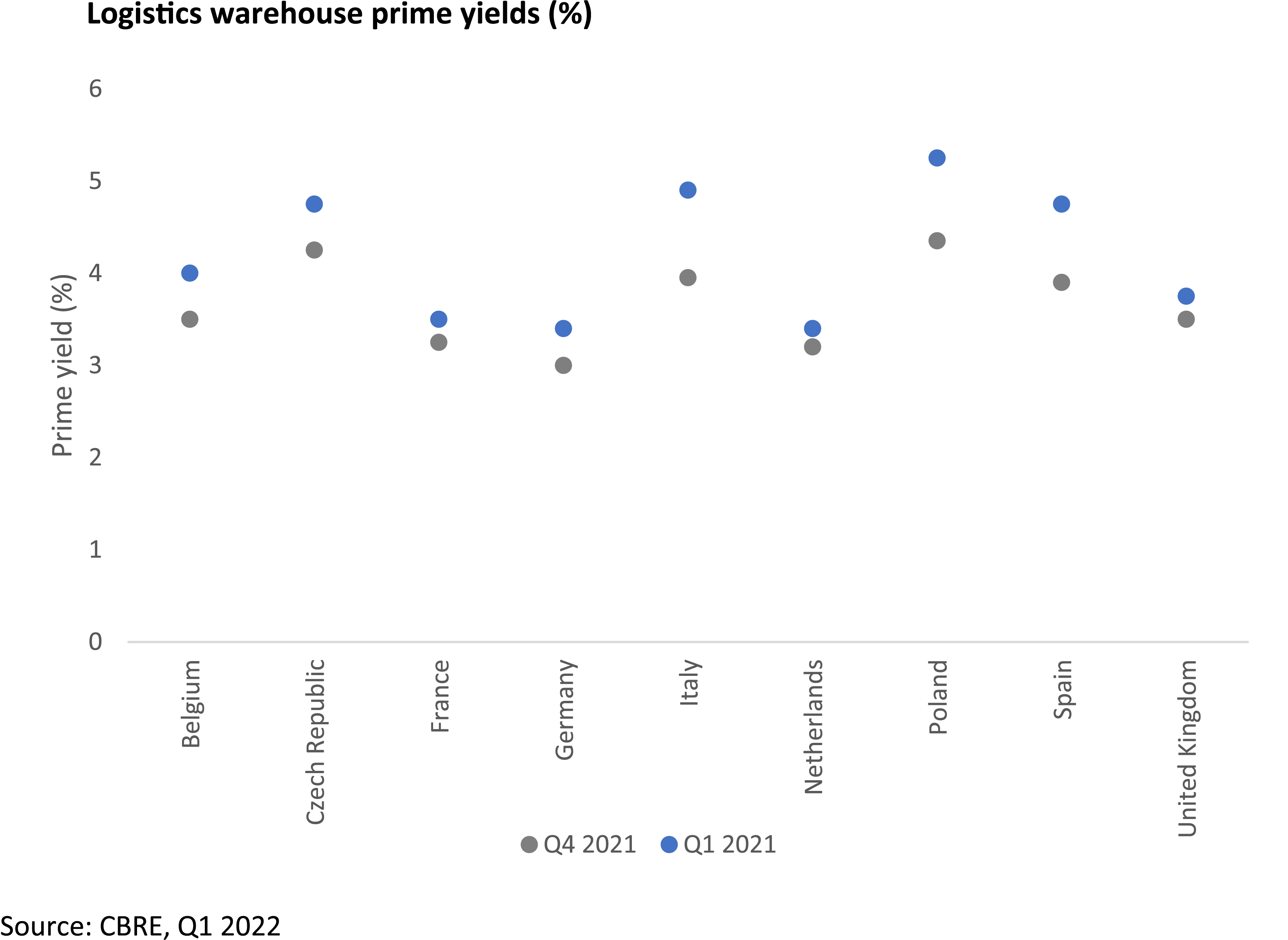

Reflecting this, investors are acquisitive. Last year some €28bn was sunk into European logistics according to RCA. German logistics/ light industrial transaction volumes in 2021 equated to €9.2bn according to Colliers or €10bn according to CBRE. With so much capital chasing such limited stock, yields are under pressure. Over the last year prime logistics yields have compressed by 40 basis points to reach 3.0% in Q4 2021 according to CBRE, and if their forecasts prove correct further moderate sharpening is likely.

This leaves many investors pondering how they can benefit from the sectors growth prospects without compromising on well-priced entry yields. In our view, informed investors have two routes in particular to secure more value: increase the light industrial allocations or gain pan-European diversification.